HSA

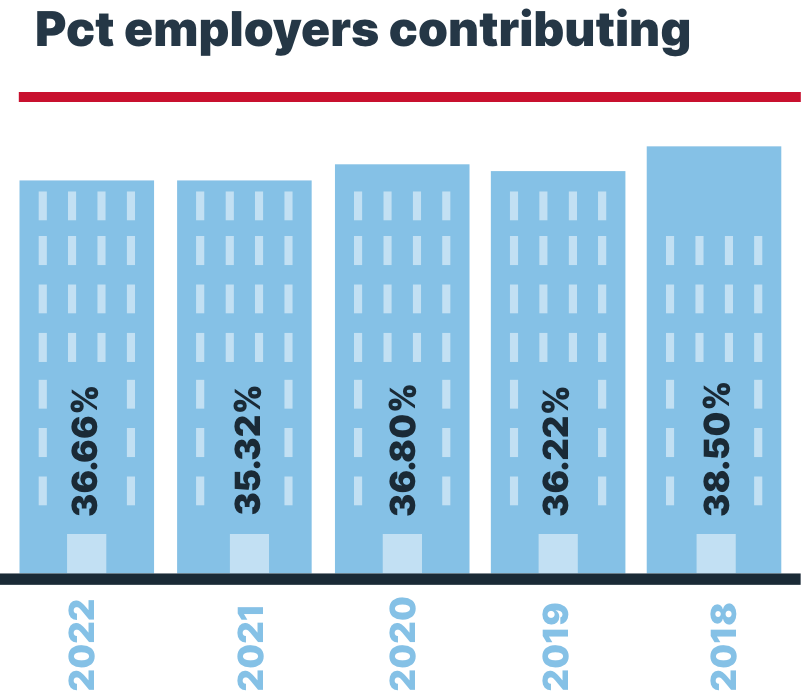

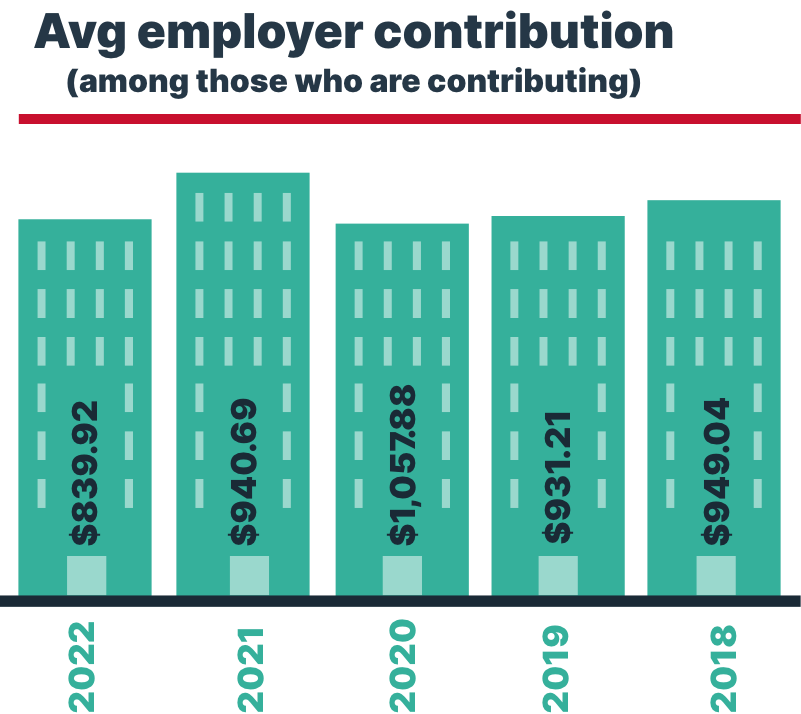

HSA employer contribution

Data is from WEX benefits platform.

What’s the employer contribution sweet spot?

Employer contributions do influence employee contributions. How do we know that? More than 7.5 million HSAs are on the WEX benefits platform, giving us unique insights into participant behavior.

Our data insights team has learned:

Any contribution

of $50 or more will encourage participation.

For family coverage

a $1,500 to $1,750 employer contribution yields the highest employee contribution.

For individuals

a $750 to $1,000 employer contribution yields the highest employee contribution.

Data is from 2022 on the WEX benefits platform

Data is from 2022 on the WEX benefits platform

87% of eligible employees enrolled in an HSA

Data is from the WEX ben admin portal

LSA

Lifestyle spending accounts

The last couple years has created a shift in needs around mental, physical, and financial employee wellness. Lifestyle spending accounts (LSAs) are perfectly positioned to support these needs.

Data is from Q1 2022

FSA

Medical FSA spending habits

Hundreds of eligible expenses are available for medical FSA participants’ funds. And that list expanded when the CARES Act permanently reinstated over-the-counter products as eligible expenses. Learn more about what participants spend their medical FSA funds on.

Breakdown of medical FSA spending by category:

42% Medical

20% Dental

18% Pharmacy

14% Vision

5% Other

Data is based on categorizing of purchases made in 2021 with FSAs on the WEX benefits platform

Percent of medical FSA funds specifically spent at:

![]()

Orthodontists: 14%

![]()

Drug stores/pharmacies: 13.7%

![]()

Optometrists/ophthalmologists: 5.8%

![]()

Opticians/optical goods/eyeglasses: 5.7%

![]()

Chiropractic: 1.9%

Medical FSA carryovers and grace periods

Data is from WEX benefits platform.

Dependent care FSAs

The COVID-19 pandemic and the emergence of flexible work arrangements has transformed the needs around child care and other dependent care needs. In 2022, we saw another average increase in the amount participants were contributing to their dependent care FSAs.

Data is from WEX benefits platform.

22% of eligible employees enrolled in an FSA

Data is from the WEX ben admin portal

Commuter Benefits

Participant spending habits

Commuter benefits can be offered to participants to cover transit or parking expenses (or both). In 2022, this is how participants on the WEX benefits platform spent their commuter benefits funds:

Data is from the WEX benefits platform.

Ben admin

Insurance

68% of eligible employees enrolled in vision

77% of eligible employees enrolled in dental

Cost of benefits

Percentage share of employer versus employee

2023: 80.9% employers; 19.1% employees

2022: 80.6% employers; 19.4% employees

2022: 83.3% employers; 16.7% employees

Voluntary benefits

50% of eligible employees enrolled in voluntary benefits

(which includes pet insurance, identity theft, legal, etc.)

24% of eligible employees enrolled in critical illness

40% of eligible employees enrolled in accident coverage

21% of eligible employees enrolled in hospital indemnity

All ben admin data is from the WEX data pool as of January 1, 2023

COBRA

Specific Rights Notice (SRN)

An SRN is a written notice outlining COBRA rights and obligations, including election forms. SRNs must be provided to all qualified beneficiaries within 14 days of receiving notice of a qualifying event.

of qualified beneficiaries who received an SRN chose to elect a plan under COBRA in 2021.

Data is via our direct clients on our LEAP platform.

Other

Recruiting and retention

What participants told us

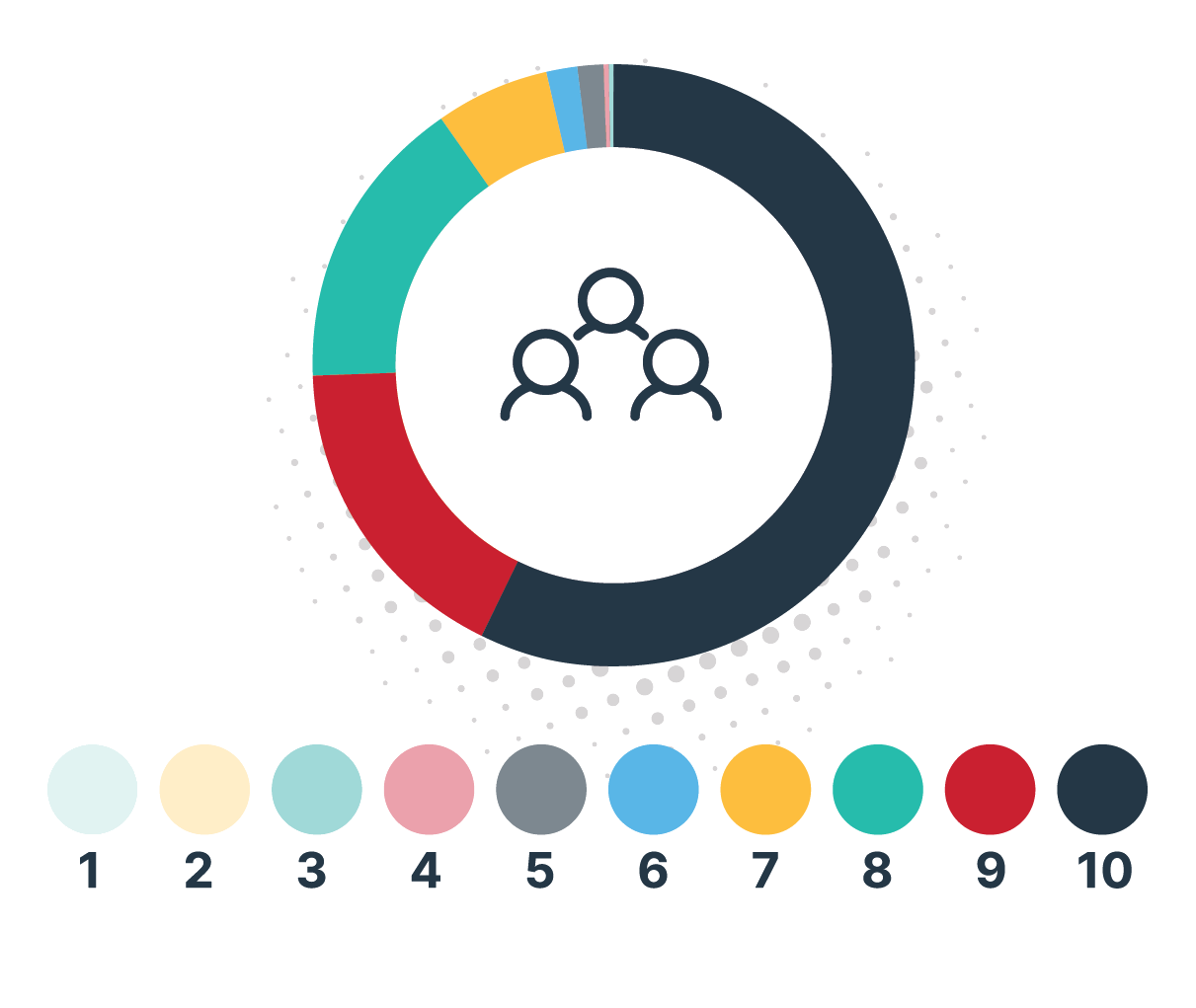

On a scale of 1 to 10, how important are health benefits to you when considering a job? Mean score was 9.11.

Nearly a quarter (23%) of participants said they don’t feel their employers’ benefits address all of their needs. That included an open form for those individuals to offer additional benefits they need. Common answers included: High deductibles, access to HSA-only or FSA-only coverage, dental, vision, and wellness.

Employee education

What participants told us

When asked on a scale of 1 to 10, how confident they are in their understanding of benefits, 25% actually said 10. However, 34% chose a number of 7 or less.

Their preferred distribution methods for benefits education are: 1) Email. 2) Handout. 3) Google search. 4) Blog posts. 5) YouTube.

Benefits that participants told us they would like more education on: 1) health savings accounts (HSAs). 2) Lifestyle spending accounts (LSAs). 3) Pet insurance.

Mental health

More than one-quarter (28%) of employers in a post-open enrollment survey told us they changed their wellness offerings to provide more mental health benefits to their employees.

What did they tell us they are expanding?

- Free or expanded telehealth

- More Employee Assistance Program (EAP) offerings

- Reduced or eliminated copays for mental health services

- More virtual and/or app capability

If your HR teams are fielding a lot of employee questions about their benefits, we’ve compiled our lists with some of the most-searched terms and articles in 2021 in our participant knowledgebase.

Terms

- Rollover

- 1099

- Account number

- Reimbursement

Articles

- Eligible expenses for benefits plans

- Claim form

- General WEX benefits card information

- Medical FSA eligible expenses

- Carryovers for FSAs FAQ